トップ > 市政情報 > 広報 > 広報誌「広報かしわ」 > Koho Kashiwa News > 2026 > Kashiwa City Community Newspaper 2026.02.01

更新日令和8(2026)年1月31日

ページID44490

ここから本文です。

Kashiwa City Community Newspaper 2026.02.01

File municipal and prefectural taxes and a final income tax return at your earliest convenience

Inquiry:

Municipal and prefectural tax = Citizens' Tax Division

TEL: 7167-1124 FAX 7167-3203

Final income tax return =Kashiwa Tax Office

TEL: 7146-2321

Filing of municipal and prefectural taxes and a final income tax return for fiscal year of 2025 (from January 1 until December 31,2025) is starting. Closing date of filing is Monday, March 16.

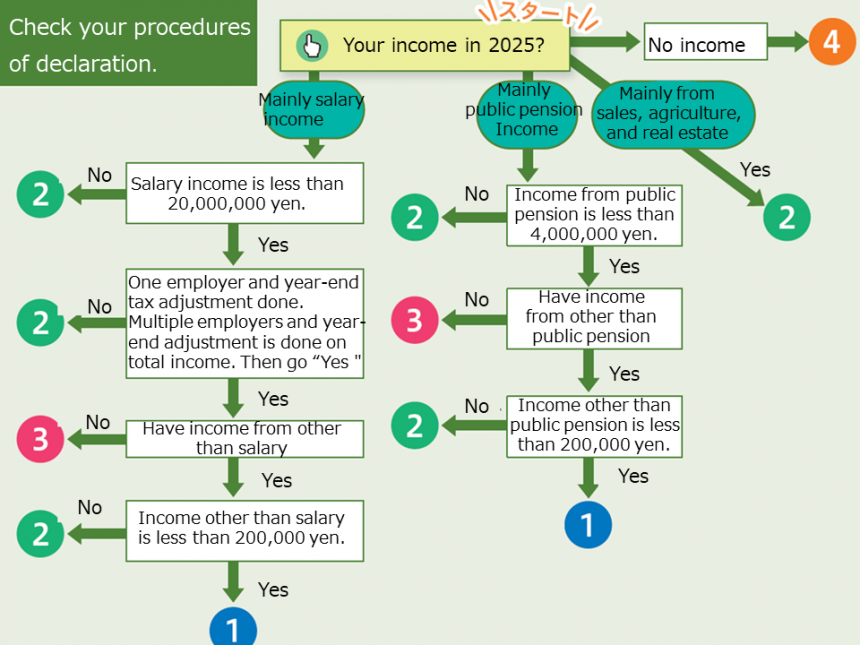

Who should file?

People whose registration of residency is in Kashiwa City as of January 1, 2026.

▶ Those who file a final income tax return do not need to file municipal and prefectural taxes.

▶Those who are filing their first special deduction for housing loans (mortgage deduction) need to file a final income tax return.

❶People who need to file municipal and prefectural taxes ➡ at City Hall

How to file forms

①tax(electronic local tax) Individual local tax filing system

You can fill in and file the local tax form for the income of 2025 on the internet.Valid electronic certificate is required. When you file the tax on the smartphone or on PC, My Number card is required.

▼eLTAX Website

②By post

Please fill out the tax return form and attach the required documents. and mail it to 277-8505 Kashiwa-shiyakusho, Shiminzei-ka (Citizens’ Tax Division, Kashiwa City Hall) by Monday, March 16 (postmark on the day is valid).

※If you need a copy of the stamped receipt for tax filing form, please enclose a self-addressed envelope with a 110-yen stamp.

③Filing your tax in person at the available tax filing sites in Kashiwa City

Only the completed tax filing forms are accepted.

<Reminder> There is not any service of consultation and assistance on tax filing by the City Hall staff.

Venues for filing municipal/prefectural tax

|

Schedule |

Venues |

Office hours |

|

From Monday, February 16 to Monday, March 16 |

Lobby of Kashiwa City Hall main buildling, 1st floor |

From 9:00am to 11:30 am, from 1:00 pm to 4:00 pm |

|

From Monday, March 9 to Monday, March 16 |

Citizens’ meeting salon, Shonan Branch office, 2nd floor |

※Not on Saturdays, Sundays and National holidays

How to obtain the forms (② and ③)only

Municipal and prefectural tax filing forms will be sent out by post on Friday, January 23 to those who filed a tax return last year. The tax filing form is not sent out to those who filed taxes last year but are not required this year; So when the filing become necessary, please contact the Citizens’ Tax Division.

Forms are available on the website of Kashiwa City.

▼Website of Kashiwa City

(QR2)

※Income tax may be refunded if you file a final income tax return. Please contact Kashiwa Tax Office for further details.

❷Final income tax return ➡ at the Kashiwa Tax Office

The final income tax return form is not available at City Hall Main Building, Shonan Branch, and community centers. When you need to obtain one, please contact Kashiwa Tax Office.

Procedures for filling out and filing the forms

▶National Tax Electronic Filing and Payment System(e-Tax)

This is a convenient system that allows filing taxes, tax payments, etc. on the internet. Valid electronic certificate is required to file a tax return. Your My Number Card is required to file a tax return using a smartphone.

▼Website of National Tax Agency

▶By post

Please send the forms and documents to the following address by Monday,March 16 by post (must arrive).

〒277−8522 Kashiwa Zeimusho (Kashiwa Tax Office)

▶Directly to Kashiwa Tax Office

<Schedule> From 9:00am to 4:00 pm from Monday, February 16 until Monday, March 16

※Not on Saturdays, Sundays and National holidays. Sunday, March 1 is open.

<Others>

▶ Entry to the site requires an advance booking on LINE app, or get an entry ticket which is distributed at the site from 8:30am. Closing time of reception may be earlier depending on the distribution situation.

▶ The forms can be submitted by posting in “the after-hours document collection box” next to the main gate of the Kashiwa Tax Office”.

▶ Parking at the Kashiwa Tax Office is not available until mid-April.

❸People who do not need to file a final income tax return, or municipal and prefectural taxes

In principle, filing is not required. However, by filing a final income tax return or municipal or prefectural taxes, you might get more deductions and the income tax refund or the municipal or prefectural tax reduction.

❹Case of no income

In principle, filing is not required. However, in case of requiring the certificate of receiving childcare allowances and disability pension, and status of no income, filing municipal and prefectural taxes must be filed.

Documents required for your tax return

Self-identification documents (My Number Card and driver’s license, etc.)

Required documents for above cases ①,②&③ (Please check.)

Required documents

|

Categories |

Documents |

|

Documents to state your income |

①Original copy of Tax Withholding Certificate for salary and public pension income, etc. ※Original copy of Record of Payment, etc. (for income sources other than those listed in ①) |

|

Documents to state the amount of the deductions |

② Original copy of the insurance amount deduction certificate (National Pension Insurance premium, life insurance premium, earthquake insurance premium, long-term general insurance premium) ③ Medical fees deduction, self-medication tax system statement ④ Any document to state the amount of payment, such as the payment receipts of National Health Insurance premium, Nursing Care Insurance premium, Latter-Stage Elderly Medical Insurance premium, etc. ⑤ Disability certificate, etc. ※This only applies to the individuals who is filing for disability deduction. ⑥Original copy of Receipts for donations |

|

Others |

⑦“My-Number” card (Two types of PIN required) ⑧Personal identification documents(Driver’s license) ※In case of sending by post, copies documents above must be attached. |

※Certificates are for 2025. Documents ①,② and ⑥ must be the original.

Major changes in taxation system from the fiscal year of 2026

From fiscal year of 2026, following points of taxation system are changed.

● Review on deduction for employment income

● Raise of the income threshold for various exemptions for dependents

● New system of Special Family Exemption

◎ Further details can be found on the website of Kashiwa City

▼Website of Kashiwa City

Have you applied for the early childhood education and care fee waiver?

Inquiry: Nursery School Administration Division

TEL: 7128−6881 FAX 7164−0741

To receive the benefits (support for the cost such as childcare fee) in accordance with the waiver system for early childhood education and care starting from April 1, it is required to obtain the certificate for the certified benefits of the facility use during March. Eligibility and maximum amount to be waived vary based on the facility of your choice and condition of the household.

Criteria of applicable family

Having challenging circumstance in childcare at home due to working parents(both), sickness, and pregnancy

|

Applicable fee to be waived |

Age of eligible child |

Maximum amount to be waived (Monthly) |

Required certificate |

|

Childcare fee for Kindergartens and Authorized Day care facilities |

3-year-olds of tax-exempted household |

16,300 yen

|

Class 3 in certified Benefit of the facility use (New class 3) |

|

3-to 5-year- olds |

11,300 yen |

Class 2 in certified Benefit of the facility use (New class 2) |

|

|

Monthly Fee for un-authorized day care facilities (※1) |

0-to 2-year-olds of tax exempted household |

42,000 yen |

Class 3 in certified Benefit of the facility use (New class 3) |

|

3-to 5-year- olds |

37,000 yen |

Class 2 in certified Benefit of the facility use (New class 2) |

※1 Registered un-authorized daycare facility satisfying the national standards for guidance and supervision (including Kashiwa City certified nursery rooms), facilities of temporary daycare service project, sick childcare project and family support center project, and baby sitters.

◎Further detail can be found on the website of Kashiwa City.

▼Website of Kashiwa City

“Guide to Waiver” is available to understand the procedure

On the website of Kashiwa City, “Early Childhood Education and Care – Is your child eligible for the waiver?” can be used to find out the eligiblity of your child. Also, “Application Guide for Waiver” is available on the website to find out the required certificates and documents.

“Cost-of-Living Support Payment for Families with Children.”

Inquiry: Dedicated phone line for “Cost-of-Living Support Payment for Families with Children.”

TEL: 7157−1379 FAX 7164−0741

Cost-of-Living Support Payment is offered to families with children. Those who are already receiving childcare allowance do not need to apply in principle. Some people such as those who are public officers and those who newly become elgible for childcare allowance after the divorce are required to apply for the payment.

Eligibility

Children born between April 2, 2007 and March 31, 2026

Amount of payment

20,000 yen per child

◎Further details on the eligibility and other information can be found on the website of Kashiwa City.

▼Website of Kashiwa City

Applications for the university entrance fee grant for low-income households are now open.

Inquiry: Dedicated line for university entrance examination fee assistance grant, Child Welfare Division

TEL: 7128−9978 FAX 7164−0741

“University entrance examination fee support grant” is offered to the household with non-taxable residential taxes and household with total annual income of less than 2,760,000 yen to support their university entrance examination fees of universities and vocational schools.

Maximum amount of support

53,000 yen per student taking entrance examination

Application Deadline

Noon, Tuesday, March 31

◎Further details on eligibility can be found on the website of Kashiwa City.

▼Website of Kashiwa City

Temporary closure of City Hall Branch Office (Kashiwa Station area) and Passport Center

Inquiry:City Hall Branch Office (Kashiwa Station area)

TEL: 7144-5050

Passport Center

TEL: 7144-5040

Due to the closue of Kashiwa Takashimaya Station Mall, they will be closed temporarily.

Closure day

Tuesday, February 24

Location

Kashiwa City Hall Branch Office (Kashiwa Station area) and Passport Center

(Kashiwa Takashimaya Station Mall Shinkan (new wing), 12F)

Services to be suspended

All branch office services and passport related services.

Test broadcast of Disaster Prevention Administration Radio

Inquiry :Disaster Prevention and Safety Division

TEL 7167-1115

A test broadcast will be conducted around 11:00am on Friday, February 6. Broadcasting will be aired simultaneously from 190 disaster prevention administration radio stations throughout the city.

Broadcasting content

Chimes → “This is a test broadcast for J-Alert.” (3 times) → “This is Disaster Prevention, Kashiwa City.”→ Chimes

Others

▶May be canceled due to a disaster, or weather conditions, etc. ▶May be held simultaneously in neighboring cities

Free legal consultation for residents of foreign language

Inquiry: Kashiwa-city Cross-cultural Center (KCC) Tel: 7157-0281

Schedule

4th Wednesday of every month (1:00pm-5:00pm)

Location

Kashiwa Cross-cultural Center (KCC) (Palette Kashiwa)

Reminder

Appointment necessary.

お問い合わせ先